Felician Sr. Maria Louise Edwards visits a man experiencing homelessness in Pomona, California. (Courtesy of Felician Sisters)

As the pandemic provoked shutdowns across the United States in March 2020, Jason's stress level began to climb. He had to handle cash as an essential employee selling car parts at an AutoZone in McKinney, Texas, a state with no mask mandate. His precarious health — asthma, sarcoidosis, chronic obstructive pulmonary disease, allergies — put him at a higher risk of serious illness should he contract COVID-19.

As his hours dwindled at work, Jason's ability to pay his bills began to depend on the opportunity to mow someone's grass for quick cash or sell whatever he could find that was sitting in his garage: the tools he still needed, or the motorcycle, which was worth twice what he sold it for. On June 8, 2020, he lost his job.

Because he was hired two days too late to qualify for unemployment assistance, Jason spent the past year improvising to pay the bills, including asking his 19-year-old daughter to contribute her wages from waitressing.

"It got me so beat down," said Jason, who asked not to use his last name because "it's embarrassing enough having to ask for assistance."

"As hard as everything is, it gets worse, like I'm not a good provider, a good father," he said. "If you can't provide for your family and you have to ask your daughter to help you out, it makes you feel pretty worthless as man."

Advertisement

Jason had an understanding landlord who was patient with his past-due rent, and he eventually received direct rent relief from Catholic Charities. However, he said he still feels like he lucked out by not having to depend on the U.S. government's temporary moratorium on residential eviction, imposed by the Centers for Disease Control and Prevention in September 2020. A mounting rent bill would have only exacerbated his stress, he said.

With millions of Americans like Jason either out of work or experiencing loss of income as a result of the pandemic, the intent of the moratorium was to prevent homelessness and the spread of COVID-19 in overcrowded shelters. (The CDC's moratorium also served as an extension of the April 2020 CARES Act, which had a narrower set of qualifications for the moratorium.)

And the ball keeps getting kicked down the road: A December expiration date turned into January, and President Joe Biden's administration initially pushed it to March 31 only to change it two days before that deadline. Now, if the expiration date doesn't change again, June 30 could mean an expensive due date for millions of renters who have accumulated up to a year of back rent.

Women religious have long ministered to people experiencing homeless or inadequate housing, running shelters and programs geared toward helping people stay off the streets. But rather than wait for a tsunami of evictions to occur on the other side of the moratorium, some sisters have started organizing fundraisers for rent and utility relief, hoping to help renters chip away at their growing bills.

"This pandemic just highlighted what everybody paying attention already knew," said Matt Janeczko, executive director of the Sisters of Charity of New York's housing program, which runs more than a dozen affordable housing projects and homeless shelters for seniors, those who have chronic mental illness, and women with children.

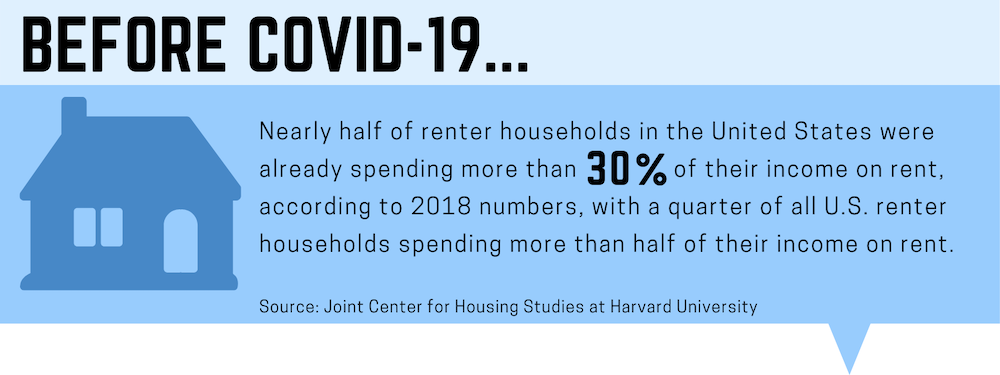

(GSR graphic/Toni-Ann Ortiz)

Even before COVID-19, the United States was already experiencing a shortage of affordable housing. Roughly 25% of renter households spend more than half their income on rent every month, and a quarter of those below the poverty line spend more than 70%, according to the Joint Center for Housing Studies at Harvard University.

"The systemic inequalities and difficulties were already here," Janeczko said. "Anybody could have told you that there was a housing crisis before this."

Financial help for the burden of bills

Meanwhile, sisters around the country are banding together to provide financially for those currently in the throes of a crisis.

The Felician Sisters got the idea for a grant at a fall council meeting in which the sisters and their lay partners brainstormed ways to be more helpful to those struggling financially because of the pandemic. They teamed up with Catholic Charities USA in December for a challenge grant, with each group contributing $1 million to what would become the Francis Fund for Eviction Prevention.

Considering the impending "tsunami of evictions around the corner," Adrian Dominican Sr. Donna Markham, president of Catholic Charities USA, suggested they focus on eviction mitigation, an issue that, unlike food donations, requires more infrastructure and organizing to address effectively, she said.

"The systemic inequalities and difficulties were already here. Anybody could have told you that there was a housing crisis before this."

—Matt Janeczko, executive director of the Sisters of Charity of New York's housing program

Because Catholic Charities has 167 agencies in 3,000 sites across the United States, "we know where people are hurting," Markham said, and they are "able to get a lot of immediate help to people in a very short time."

Named after St. Francis of Assisi, the Felicians' founding spirit, the $2 million Francis Fund continues to garner donations and has since raised an additional $250,000.

"The Felicians reaching out to us jump-started an incredible project to help people," Markham said. "That was so absolutely astounding."

The Francis Fund is just one piece of a larger, ongoing initiative that Catholic Charities agencies oversee in providing housing assistance, but it is an "added force to helping people," Markham said.

When Jason applied for assistance from Collin County, Texas, they put him in touch with Catholic Charities of Dallas, which is covering his $1,875 in monthly rent while he takes care of the utilities and all other expenses. With what he could sell on Facebook plus his daughter's wages as a waitress, "I wasn't going to take advantage of anything else if I could hustle and make enough money to keep water and electric paid," he said.

With a desire to alleviate the burden of bills for people like Jason, the Sisters of Charity of New York also set up a fund that would help those on the verge of eviction or who needed money for utilities.

Sr. Donna Dodge, the congregation's president, said they are operating on a relatively small scale through word of mouth, turning to their fellow sisters, friends and relatives for donations. Their first recipient burst into tears when they offered financial relief, she said.

"I do hope that the grassroots money will begin to come in so we can sustain this because the problem is not going to go away," she said.

Felician Sisters take a photo with people they shared food with who are experiencing poverty in Enfield, Connecticut, before the pandemic. (Courtesy of Felician Sisters)

But even if congregations or Catholic Charities do their best to address the crisis as charitable organizations, Markham said, "we realize full well that this can't be the responsibility of charities alone. This demands a lot of robust advocacy efforts with Congress and the [Biden] administration to get help."

The moratorium, Markham said, "only postponed the inevitable."

Janeczko agreed, calling it an "artificial fix."

"It's really easy to say, 'We're going to cancel rent.' But when the boiler breaks in the building, how do you think we're going to pay the plumber?"

'There's not a positive'

Shortly before the stimulus bill came out in December, the National Real Estate Investors Association conducted an informal survey among its members — mostly small landlords and house flippers — asking how the eviction moratorium was affecting them.

About a third of the small landlords (those who own 25 units or fewer) said if something didn't change in the next six months, they were "going under," said Charles Tassell, the association's chief operations officer.

The National Multifamily Housing Council's Rent Payment Tracker found that, as of March 6, roughly 20% of apartment households are not current on their rent; in 2020, estimates of lost rent range from $27 billion to $60 billion despite federal relief.

"The brunt of this whole pandemic has fallen on service workers, which translates to small property owners who are renting to them," Tassell said, adding that this demographic owns more than half the rental property in the United States.

"It's not so simple as 'landlords bad, renters good,' " Janeczko said. "Nobody actually ever thinks what the back-end consequences are, and housing is really expensive to maintain. ... Bad landlords are always going to find a way to make money. That's what they do. But if you squeeze out good landlords, that's when things are going to get bad."

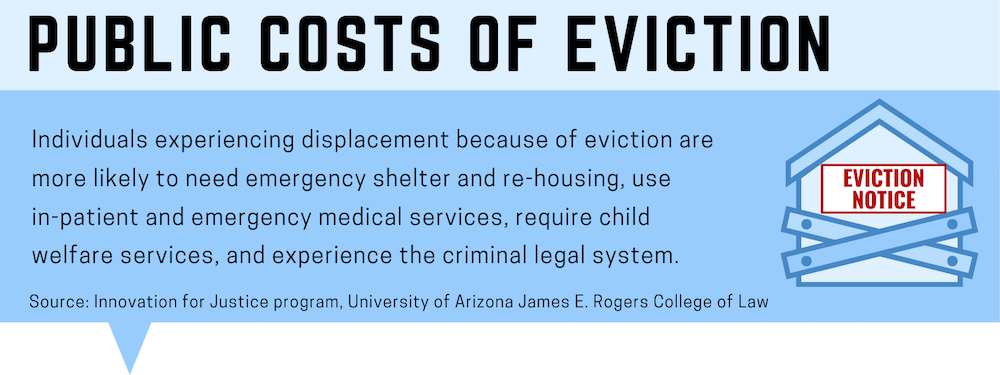

(GSR graphic/Toni-Ann Ortiz)

The National Real Estate Investors Association encourages its landlord members to be in constant communication with their residents and to offer help and resources to those struggling with job loss, Tassell said.

"Most property owners, especially small property owners, are your neighbors."

Jason said having a sympathetic landlord has been instrumental in keeping his stress from compounding. When he told his landlord that he was unable to pay rent but was applying for grants, his landlord was understanding: "Do what you got to do," he was told.

But eventually, Jason said he "couldn't stand it anymore." He knew his landlord had his own expenses and a bank to answer to.

"I felt like I was living here for free," he said.

While the eviction moratorium shields tenants from paying their monthly rent, Tassell said "behind the scenes, the bank bill keeps coming due," including property taxes, contractor fees and regular maintenance. With most properties operating on 5% to 10% margins, there's little leeway for some landlords to earn an income.

"That's what could take these folks under," Tassell said.

Tassell, who owns a 26-unit building in Cincinnati, Ohio, said eviction is "the soul-killing part of the job" that incurs multiple expenses and inconveniences for both parties. However, the eviction moratorium is "more a struggle than anything else. There's not a positive."

An effective alternative to the government moratorium's "belt-and-suspenders approach" is the Emergency Rental Assistance Program, Tassell said. The $25 billion in aid, part of the coronavirus relief appropriation bill signed into law in December, directly helps both renters whose income has been affected by the pandemic as well as the "the next set of dominos" that falls to the landlord, such as mortgage, maintenance and property taxes. The Biden administration's American Rescue Plan signed into law in March adds another $21.6 billion to the emergency rental assistance effort.

"It's the right way to help," Tassell said.

Janeczko said he often thinks about the emotional toll the moratorium inflicts on tenants, those who wake up every day knowing that, eventually, several months of rent will be due while their savings are still dry.

The pandemic, Janeczko said, has exposed that a large number of Americans don't have savings and can't afford their housing.

"The current housing situation is a symptom, not the ailment. This was the straw that broke the camel's back."